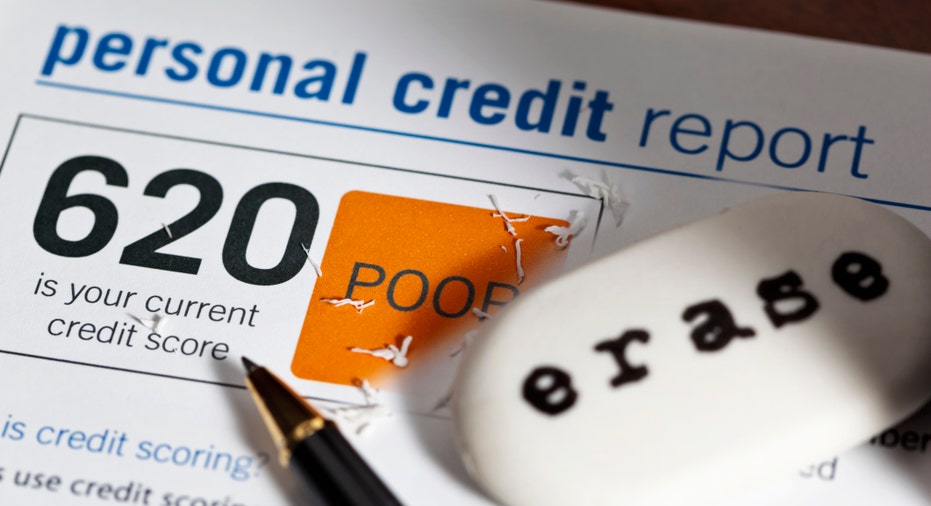

How Can I Build My Credit Score Fast

Here are six tips on how to build up your credit as fast as possible. ( iStock )

Whether y'all've just taken out your get-go card or your score only needs a boost, odds are proficient that you're looking to build credit fast. The truth is that having a good credit score can open the doors to and so many things. For case, when combined with a down payment, a good score could be the primal to becoming a homeowner.

With that in heed, below are six tips on how to build up your credit as fast as possible and chop-chop better your score.

Check your credit study for errors

If you already accept a credit history and want to maximize your score, the first thing to exercise is to check your credit report for any errors. A error on ane of your payment and billing statements -- such every bit a payment that was marked late when you lot really made it on fourth dimension -- could be office of the problem.

HOW PERSONAL LOANS Impact CREDIT SCORES

Users are entitled to one free credit report per year from each of the free credit bureaus. You tin asking copies of your reports by going to AnnualCreditReport.com. After receiving your copies, yous should advisedly review them to ensure that all the information is correct.

If y'all exercise find an error, you can dispute it past writing a letter to the credit reporting agency to explain the situation. From there, the credit bureaus have 30 days to open an investigation and xc days to decide whether they need to make a change to your report.

Become an authorized user

If yous're non quite set up for a carte of your own, you tin ask to become an authorized user on someone else'southward account. Authorized users have the ability to employ the other person's card, but don't accept the responsibility of making payments.

WHAT CREDIT Carte du jour SHOULD YOU Go? HOW TO CHOOSE THE All-time 1 FOR Y'all

Once yous're added to the card, that account's entire history is factored into your score, so ideally, y'all'll desire to ask someone who has a solid credit score.

Become a secured menu

One time y'all're set up to get a card of your ain, try for a secured card. A secured carte requires a eolith to open it, which is then used as your line of credit. Since the lender holds on to your deposit and there's no risk that they won't be paid dorsum, these cards mostly have much easier qualifying standards and lower fees than traditional cards that are targeted toward people with poor or limited credit.

Pay your neb in full each month

Believe it or not, your payment history accounts for a whopping 35 percent of your credit score. With that in mind, when your goal is to build your credit score, it's very important to invest time and free energy into making sure you pay your bill in full each month. Additionally, don't spend more than than you know that you can afford to pay back and remember to make your payments on time.

WHAT APR MEANS ON YOUR CREDIT CARDS AND LOANS

Enquire for a higher credit limit

If you've been paying your bills on fourth dimension for a while and slowly working on building your score, some other thing to do is ask for a higher credit limit. When your limit goes up and your spending stays the same, your credit utilization goes down. Credit utilization refers to the amount of credit you're using out of your full credit available. It's all-time to effort to keep this pct as low as possible.

Create a better credit mix

There are two types of credit: revolving credit and installment loans. With revolving credit, like credit cards, you lot can choose how much you lot pay toward your debts. In contrast, with an installment loan, y'all have to make the same fixed payment every month. If you have generally i type of credit, consider getting the other to create a better credit mix.

Source: https://www.foxbusiness.com/money/increase-credit-score-fast

0 Response to "How Can I Build My Credit Score Fast"

Post a Comment